Advanced Micro Devices (AMD) has reported a significant milestone, with its data center revenue exceeding $4 billion in the latest quarter. This growth is driven by increased demand for AI accelerators and strategic partnerships, positioning AMD as a formidable competitor in the AI chip industry.

Advanced Micro Devices (AMD) has achieved a remarkable milestone, with its data center revenue surpassing $4 billion in the most recent quarter. This surge is largely attributed to the escalating demand for AI accelerators and strategic collaborations with major technology firms, solidifying AMD’s position as a formidable contender in the AI chip market.

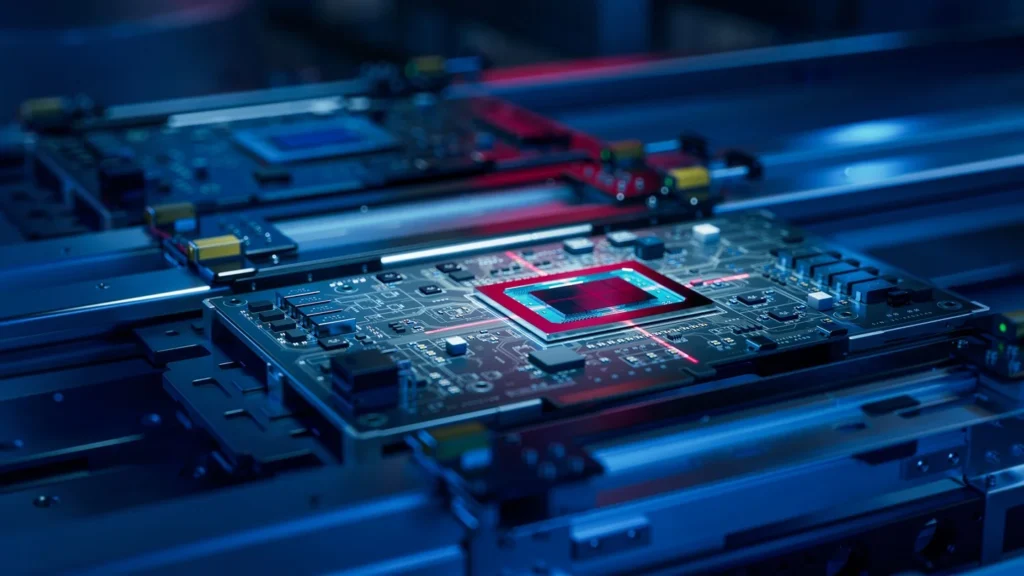

Robust Growth in Data Center Segment

In the third quarter, AMD’s data center segment reported revenues exceeding $4 billion, marking a significant year-over-year increase. This growth is primarily driven by the heightened demand for AI accelerators, as companies increasingly invest in advanced computing solutions to support artificial intelligence applications. AMD’s CEO, Lisa Su, highlighted the company’s commitment to meeting this demand, stating, “We are ramping production of our MI300 AI accelerators to address the growing needs of our customers.”

Strategic Partnerships and Product Launches

AMD’s success in the data center market is bolstered by strategic partnerships with industry giants such as Microsoft and Meta. These collaborations involve the integration of AMD’s MI300 GPUs into the tech giants’ data centers, enhancing their AI processing capabilities. Additionally, AMD is in discussions with Amazon to expand its customer base further.

In a bid to compete with market leader Nvidia, AMD has introduced the MI325X AI chip, slated for mass production in the fourth quarter. This new processor is designed to offer enhanced performance and efficiency, aiming to close the gap with Nvidia’s dominant AI processors. Looking ahead, AMD plans to launch the MI350 chip in the second half of 2025, which is expected to rival Nvidia’s next-generation Blackwell system.

Market Dynamics and Competitive Landscape

Despite AMD’s impressive growth, Nvidia continues to hold a substantial share of the AI chip market, with more than 80% market dominance. This is partly due to Nvidia’s development of core software widely adopted by AI engineers. However, AMD is making strategic moves to increase its market share, including the anticipated $5 billion in AI chip sales this year. The company projects the total AI chip market to reach $500 billion by 2028, indicating ample opportunity for expansion.

Financial Performance and Future Outlook

AMD’s overall financial performance reflects its strategic focus on high-growth areas. While the data center and personal computer segments have shown robust growth, with the latter increasing by 29% in the September quarter, the gaming unit experienced a decline of approximately 69% during the same period. This shift underscores AMD’s strategic pivot towards sectors with higher demand and profitability.

To align resources with growth opportunities, AMD announced a workforce reduction of approximately 4%. This decision aims to streamline operations and focus on areas with the highest potential for expansion, particularly in AI and data center technologies.

As AMD continues to innovate and expand its product offerings, the company is well-positioned to capitalize on the burgeoning AI market. With strategic partnerships, advanced product development, and a clear focus on high-growth sectors, AMD is poised to enhance its competitive stance in the rapidly evolving semiconductor industry.