As the global community races to transition from fossil fuels to clean energy, a new report from the International Energy Agency (IEA) has raised alarm bells: the world’s clean energy ambitions are increasingly vulnerable due to a heavy reliance on a small number of countries for critical mineral supply, and China, in particular, has emerged as a dominant force.

In its newly released Global Critical Minerals Outlook 2024, the IEA cautions that the supply of essential minerals, such as lithium, cobalt, nickel, copper, and rare earth elements, remains dangerously concentrated. These minerals are indispensable for the production of electric vehicles, renewable energy infrastructure, grid storage systems, and semiconductors. Without them, a low-carbon future remains out of reach.

Yet the geographic sources of these minerals, and more importantly, the locations where they are refined, are narrowing. According to the report, just three countries now control 68% of total global mineral production. In mineral refining, the picture is even more stark: the top three nations command a staggering 90% of processing capacity. At the centre of it all is China.

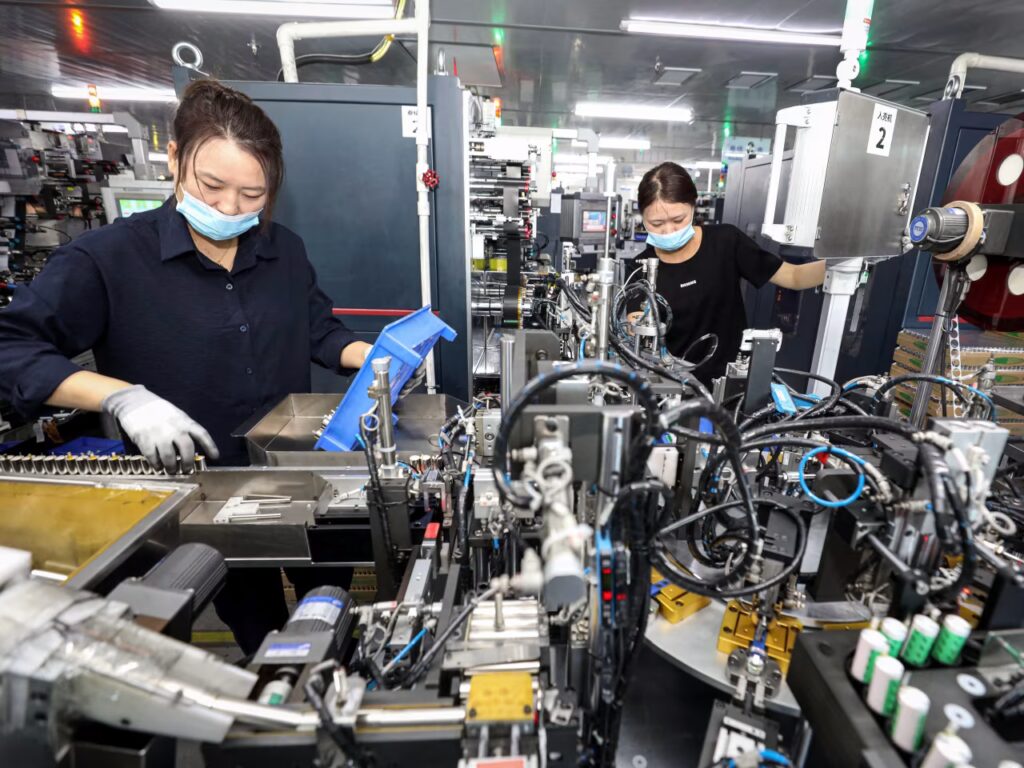

China alone accounts for over half of the world’s refining capacity for lithium, cobalt, and rare earth elements, minerals critical to clean energy technologies and defence systems. While this dominance has been building for years, it has now become a major source of geopolitical tension, particularly in the wake of recent export curbs imposed by Beijing on materials such as graphite, gallium, and germanium.

These restrictions, viewed by many as retaliatory trade measures, have intensified international concerns about supply chain stability. The IEA warns that an over-concentration of supply in politically sensitive regions could severely disrupt global energy transition plans, causing price volatility and undermining industrial competitiveness.

“Even in a market that appears well-supplied, the risk of supply shocks is high, whether from extreme weather, technical failures, or geopolitical strife,” said Fatih Birol, Executive Director of the IEA. “A single disruption could ripple across industries and regions, leading to higher costs and lost momentum on climate action.”

The consequences of inaction could be dire. The IEA forecasts that demand for copper alone, crucial for electric grids and EVs, may outstrip supply by as much as 7 million tonnes by 2035 unless new mining and refining projects are accelerated. Similarly, demand for lithium and cobalt is expected to continue climbing sharply, driven by global EV adoption.

While global investment in critical minerals development grew by 10% in 2023, the pace remains insufficient to meet projected demand. Most of the growth in lithium refining, for example, occurred exclusively in China last year. Meanwhile, projects in Africa and Latin America, where many mineral reserves lie untapped, are struggling to get off the ground due to a lack of infrastructure, financing, and political stability.

In response to the risks highlighted by the IEA, several governments, including the United States, members of the European Union, and other advanced economies, are pushing to diversify their mineral supply chains and reduce dependency on China. This includes efforts to secure long-term sourcing agreements, create strategic mineral reserves, and invest in domestic mining and refining capacity.

However, the IEA stresses that simply building more mines is not the full answer. The report urges a comprehensive approach that includes environmental stewardship, responsible labor practices, and meaningful engagement with mineral-rich developing countries. The goal is to foster transparent, resilient supply chains that align with both climate and social justice goals.

“Ensuring reliable and sustainable access to critical minerals isn’t just a technical challenge, it’s a moral and geopolitical one,” said Birol. “It’s essential to ensure that communities in resource-rich nations benefit from the energy transition and are not left behind.”

The IEA’s warning lands at a pivotal time, with world leaders preparing for COP30 in Brazil next year. While recent climate summits have focused largely on emissions targets and renewable deployment, the spotlight is now shifting to the raw materials that make the transition possible. Without secured access to these minerals, even the most ambitious clean energy pledges could falter.

If the world is serious about hitting net-zero goals and building a greener global economy, it must act now to diversify mineral supply chains, strengthen international cooperation, and invest in a more equitable and resilient resource system.

Concludes: “The path to a sustainable energy future is paved not only with solar panels and wind turbines, but with copper, lithium, and cobalt. And the time to secure those foundations is running out.”